H&R Block Tax Review : H&R Block is a tax preparation company that provides tax filing services for individuals, small businesses, and corporations. The company was founded in 1955 by Henry and Richard Bloch and is headquartered in Kansas City, Missouri.

H&R Block offers a range of tax preparation services, including online and in-person tax preparation, as well as tax planning and advisory services. The company also offers tax software, which can be used by individuals to prepare their taxes on their own.

H&R Block employs tax professionals who are trained to help clients maximize their tax refund and minimize their tax liability. They are knowledgeable about tax laws and regulations and can help clients navigate complex tax situations. -H&R Block Tax Review

H&R Block is a reputable company with a long history of providing tax preparation services. If you need help with your taxes, H&R Block may be a good option to consider. -H&R Block Tax Review

H&R Block Tax Review

H&R Block’s electronic filing products are intuitive and easy to use, and the free version offers applicants a rich choice of forms. While it’s not the most expensive tax software we’ve reviewed, H&R Block’s online tax software isn’t the cheapest.

Still, the free version is one of the best on the market, with its easy-to-use interface and on-screen human assistance at an additional cost. -H&R Block Tax Review

H&R Block’s prices

H&R Block’s prices vary depending on the type of service you need and the complexity of your tax situation. Here are some of the pricing options for H&R Block’s tax preparation services:

It’s important to note that H&R Block’s prices are subject to change and can vary depending on the specific location and tax professional you work with. It’s best to check with H&R Block directly or consult their website for the most up-to-date pricing information.

What you get from H&R Block’s free version

H&R Block offers a free version of its online tax filing software, called “Free Online”. Here’s what you can expect to get from H&R Block’s free version: -H&R Block Tax Review

- Federal Tax Filing: You can file your federal tax return for free using H&R Block’s free version.

- State Tax Filing: State tax returns can be filed for an additional fee, typically ranging from $19.99 to $44.99 depending on the state.

- W-2 Import: You can import your W-2 form directly into H&R Block’s tax software, which can save you time and reduce the risk of errors.

- Basic Support: You’ll have access to basic customer support from H&R Block’s tax professionals, including chat and email support.

- Refund Reveal: H&R Block’s refund reveal feature shows you how and why your refund amount is changing in real-time as you complete your tax return.

It’s important to note that H&R Block’s free version is designed for simple tax returns, such as those with only W-2 income, limited interest or dividend income, and no itemized deductions. If you have a more complex tax situation, you may need to upgrade to a paid version of H&R Block’s tax software or use their in-person or virtual tax preparation services.

H&R Block’s ease of use

H&R Block’s tax preparation software is generally considered to be easy to use. The software guides you through each step of the tax preparation process, asking questions about your income, expenses, and deductions to ensure that you’re getting all the tax credits and deductions you’re entitled to.

The software is also designed to be user-friendly, with a simple, intuitive interface and clear instructions. H&R Block’s tax software includes features such as W-2 import, which can help save you time and reduce the risk of errors when entering information into your tax return. -H&R Block Tax Review

If you have questions or need assistance while using H&R Block’s tax software, you can access customer support through chat, email, or phone. H&R Block also offers in-person and virtual tax preparation services, which can provide additional support and guidance if you need it. -H&R Block Tax Review

How it works H&R Block’s

H&R Block’s tax preparation process works as follows: -H&R Block Tax Review

- Choose Your Tax Filing Option: First, you’ll need to choose the tax filing option that best fits your needs. H&R Block offers a variety of options, including online tax filing, in-person tax preparation, and virtual tax preparation.

- Create an Account: Once you’ve chosen your tax filing option, you’ll need to create an account with H&R Block. This will allow you to save your tax return information and access it later if needed.

- Enter Your Information: Next, you’ll need to enter your personal information, including your name, address, and social security number. You’ll also need to enter information about your income, expenses, and deductions.

- Review Your Return: Once you’ve entered all of your information, H&R Block’s software will review your tax return to ensure that you’re getting all the tax credits and deductions you’re entitled to.

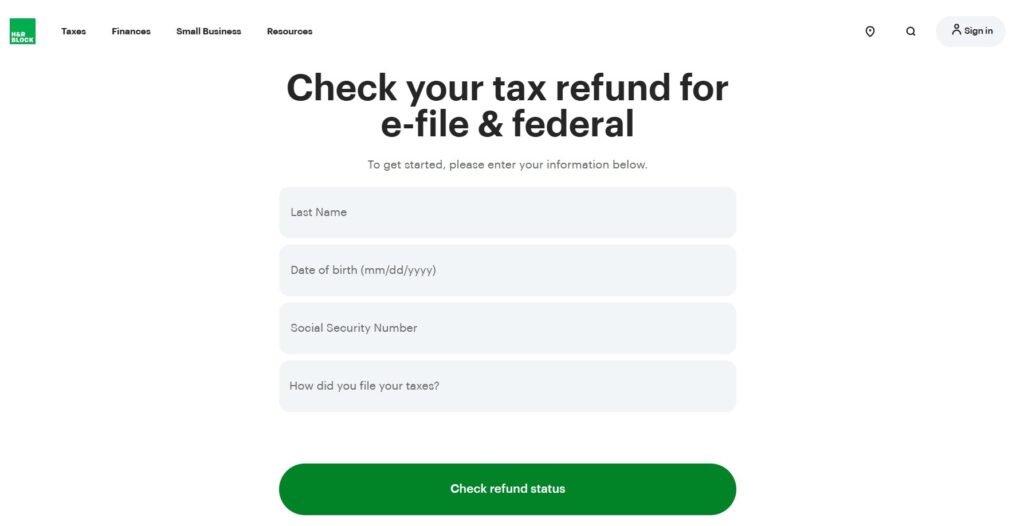

- File Your Return: If you’re satisfied with your tax return, you can file it electronically using H&R Block’s software. You can also choose to print your return and file it by mail.

- Get Your Refund: If you’re due a refund, you can choose to have it deposited directly into your bank account or receive a check in the mail.

If you have questions or need assistance at any point during the tax preparation process, you can access customer support through chat, email, or phone. H&R Block’s tax professionals are trained to help you navigate complex tax situations and maximize your tax refund. -H&R Block Tax Review

What it looks like H&R Block’s

H&R Block’s tax preparation software has a user-friendly interface that is designed to guide you through each step of the tax preparation process. Here’s what it looks like: -H&R Block Tax Review

- Dashboard: The dashboard is the first screen you’ll see when you log in to H&R Block’s tax software. It provides an overview of your tax return and allows you to access different sections of the software, including your personal information, income, expenses, and deductions.

- Personal Information: The personal information section allows you to enter your name, address, and other personal details that are necessary for filing your tax return.

- Income: The income section allows you to enter information about your income, including W-2s, 1099s, and other forms of income.

- Deductions: The deductions section allows you to enter information about your deductions, including charitable contributions, mortgage interest, and other deductions.

- Review: The review section allows you to review your tax return and make sure that all of your information is accurate and complete.

- E-file: Once you’re satisfied with your tax return, you can choose to file it electronically using H&R Block’s software. You can also choose to print your return and file it by mail.

H&R Block’s tax preparation software has a clean and simple interface that is easy to navigate. The software is designed to guide you through each step of the tax preparation process and ensure that you’re getting all the tax credits and deductions you’re entitled to. -H&R Block Tax Review

H&R Block’s human tax help

H&R Block offers a variety of options for human tax help, including in-person, virtual, and chat-based support. -H&R Block Tax Review

1 – In-Person Tax Help

H&R Block has thousands of physical office locations across the United States where you can meet with a tax professional in person. These professionals can help you prepare and file your taxes, answer questions about your tax situation, and provide guidance on tax planning and strategy. In-person tax help can be especially helpful if you have complex tax issues or if you prefer to work with a tax professional face-to-face.

2 – Virtual Tax Help

H&R Block also offers virtual tax preparation services, where you can work with a tax professional remotely via video chat or phone. This can be a convenient option if you’re unable to visit an in-person office location, or if you prefer the convenience of working with a tax professional from the comfort of your own home.

3 – Chat-Based Tax Help

H&R Block also offers chat-based tax help, where you can chat with a tax professional online or via the H&R Block mobile app. This can be a quick and convenient way to get answers to your tax questions or to get help with your tax return.

In all cases, H&R Block’s tax professionals are trained to provide personalized and expert advice to help you get the most out of your tax return. -H&R Block Tax Review

H&R Block’s support options

H&R Block offers several support options to help customers with their tax preparation needs, including

- Customer Support: H&R Block’s customer support team is available via phone, email, or chat to help customers with any questions or concerns they may have. You can contact customer support during business hours, and they’ll be happy to help you with any issues you may encounter while using H&R Block’s tax software.

- Knowledge Base: H&R Block has an extensive online knowledge base that provides answers to common questions about tax preparation and filing. This resource can be accessed 24/7 and covers a wide range of tax topics.

- Community Forum: H&R Block’s community forum is a place where customers can ask and answer questions related to tax preparation and filing. This is a great resource for getting advice and feedback from other H&R Block customers.

- Tax Professionals: H&R Block has a team of tax professionals who can help customers with their tax preparation needs. These professionals can provide expert advice on tax planning and strategy, as well as help customers prepare and file their tax returns.

H&R Block offers a variety of support options to help customers with their tax preparation needs. Whether you need help with a specific issue or just have general questions about tax preparation, H&R Block’s customer support team and other resources are available to assist you. -H&R Block Tax Review

H&R Block’s If you’re Audited

If you’re audited by the IRS after using H&R Block’s tax software, H&R Block offers audit support to its customers. Here’s how it works -H&R Block Tax Review

- Free Audit Support: If you receive an audit notice from the IRS, H&R Block will provide you with free audit support, regardless of which version of their tax software you used. This includes guidance on how to respond to the IRS and assistance in gathering and organizing the necessary documents.

- In-Person Audit Representation: If you used H&R Block’s tax software and are audited by the IRS, H&R Block can also provide in-person audit representation. This service is provided by a tax professional and is available for an additional fee.

- Peace of Mind® Extended Service Plan: H&R Block also offers a Peace of Mind® Extended Service Plan, which provides additional audit support and representation in the event of an IRS audit. This service is available for an additional fee at the time of purchase of H&R Block’s tax software.

H&R Block’s audit support can provide peace of mind to customers who are concerned about being audited by the IRS. By offering free audit support and additional audit representation services for an extra fee, H&R Block ensures that its customers have access to the resources they need to navigate the audit process. -H&R Block Tax Review

H&R Block’s getting a tax refund

H&R Block offers several options for customers to receive their tax refund, including: -H&R Block Tax Review

- Direct Deposit: The fastest and most secure way to receive your tax refund is through direct deposit into your bank account. When you file your tax return with H&R Block’s tax software, you can provide your bank account information and the IRS will deposit your refund directly into your account.

- Prepaid Debit Card: H&R Block also offers a prepaid debit card option for customers who do not have a bank account or who do not want to use direct deposit. When you file your tax return with H&R Block, you can choose to have your refund loaded onto a prepaid debit card, which can be used to make purchases or withdraw cash from ATMs.

- Paper Check: If you prefer to receive a paper check, you can choose this option when you file your tax return with H&R Block’s tax software. However, this option may take longer to receive than direct deposit or the prepaid debit card option.

H&R Block makes it easy for customers to receive their tax refunds in a way that is most convenient for them. Direct deposit and the prepaid debit card option are typically the fastest and most secure options, while a paper check may take longer to receive. -H&R Block Tax Review

Conclusion

H&R Block is a popular tax preparation software that offers a wide range of features and options to help individuals and businesses prepare and file their tax returns. H&R Block’s tax software is easy to use and offers a variety of support options to help customers with their tax preparation needs, including access to tax professionals, customer support, an online knowledge base, and a community forum.

Additionally, H&R Block offers options for customers to receive their tax refunds through direct deposit, prepaid debit card, or paper check. Overall, H&R Block is a solid choice for individuals and businesses looking for a reliable and convenient way to prepare and file their tax returns. -H&R Block Tax Review